The top 10 micropolitan areas for raising venture capital

Using SEC Form D data to identify which micropolitan areas have been hotbeds for venture capital investment.

Venture capital funding plays a pivotal role in bolstering a region’s economy by catalyzing innovation, fostering job creation, and attracting talent.

Venture capital investment injects vital funding into promising businesses with growth potential, enabling them to scale rapidly. And it holds immense promise for revitalizing rural America’s economy by empowering local entrepreneurs with the resources needed to innovate and grow.

Though rural areas have traditionally been overlooked by investors, many rural entrepreneurs have managed to access capital that is crucial to transforming their budding ideas into thriving businesses.

To explore the venture capital landscape in rural America, we can use the SEC’s Form D to identify the amount of funding received by private businesses in micropolitan areas. A micropolitan area, as defined by the U.S. Office of Management and Budget, is a region centered around a small urban cluster with a population between 10,000 and 50,000 people. These areas are smaller than metropolitan areas but still exhibit economic and social connections with nearby population centers, making micropolitans an ideal geography for observing venture capital dynamics in rural economies.

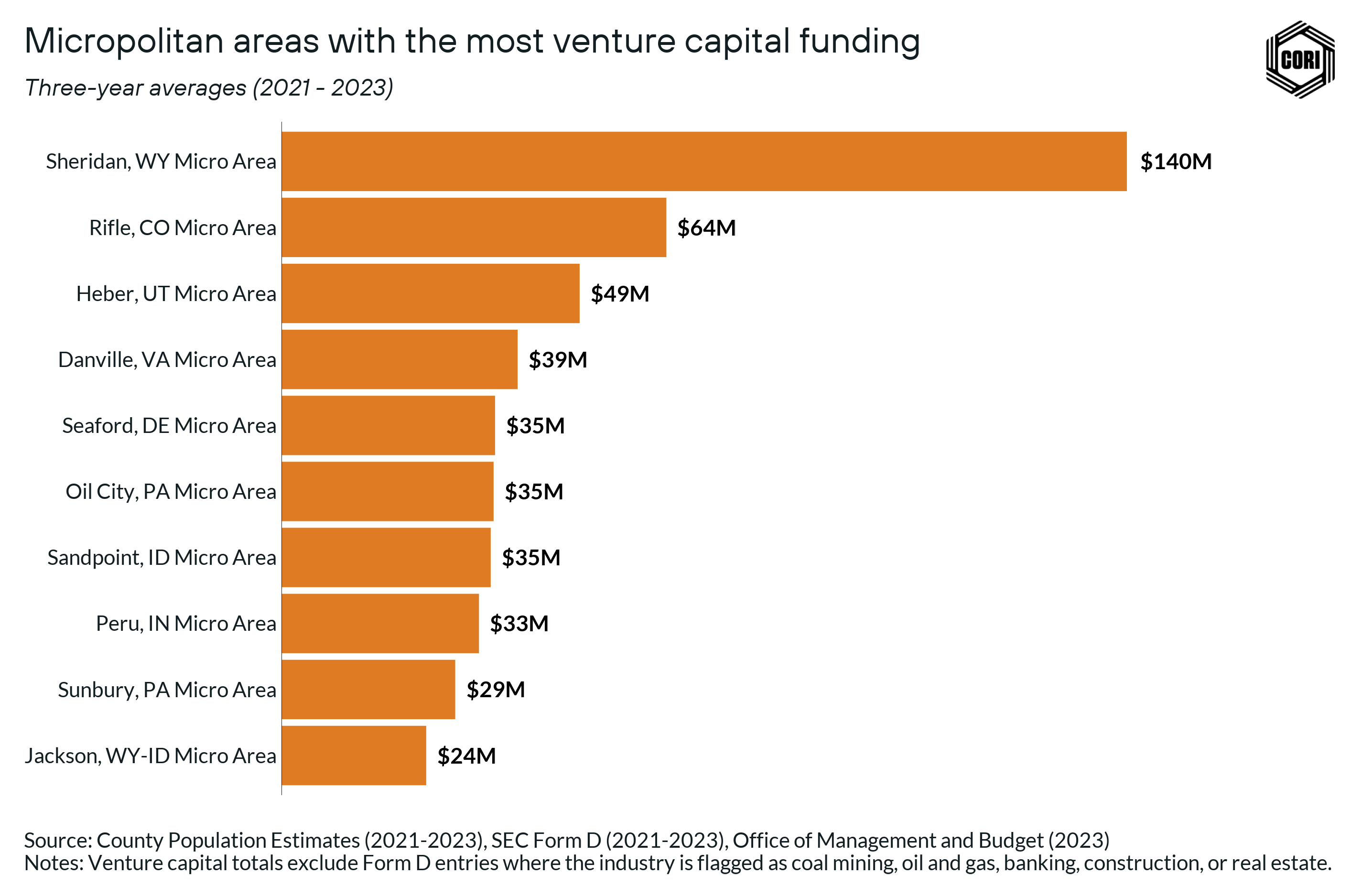

Here are the micropolitan areas that raised the most venture capital each year (on average) over the three years from 2021 to 2023:

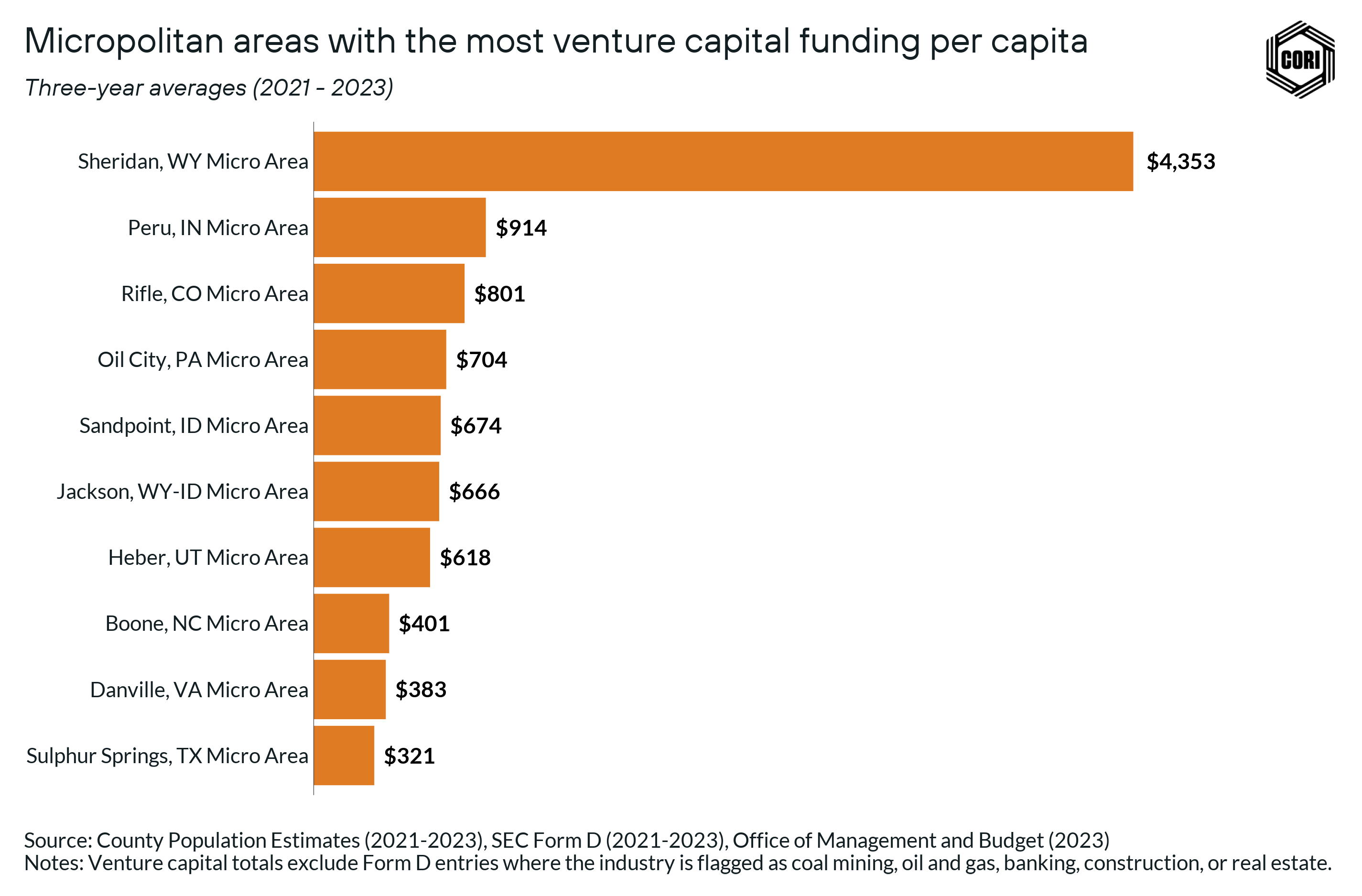

And here are the micropolitan areas that raised the most in venture capital funding per capita each year (on average) over the same three-year-span:

What we learned when we examined the data:

- Sheridan, Heber, Rifle, Seaford, and Jackson achieved these outcomes through an abundance of venture capital activity, while the others were driven by a couple companies with very large deals during this time period.

- Of the 178 micropolitans that raised capital through Regulation D from 2021 to 2023, the 10 that raised the most represent 57% of the $851 million in funding that went to micropolitan areas each year on average.

- The 10 micropolitans with the most funding per capita varied widely by population size. Sheridan, Wyoming, had the smallest population (32,069), while the population of Danville, Virginia, (101,857) was much larger than the others on this list. Heber, Utah, was the second-largest micropolitan area in the top 10 (79,656).

Each of these communities demonstrate that rural communities are ripe with entrepreneurial spirit and offer investors an abundance of opportunities.

* Editor’s note: This post has been updated. A previous version of this blog presented data from 2022 alone in places that were defined as micropolitan statistical areas based on the results of the 2010 Census. Some areas no longer qualified as micropolitan areas based on 2023 population estimates.

Interested in learning more about rural data?

This post is an excerpt from the CORI data team’s GitHub blog, where they share insights and key learnings from their in-depth work with rural data. If you have questions about this post or other rural research, get in touch with the CORI data team today.

And if you’d like to dig deeper on the power of direct investment in rural startups, check out our seed fund, the CORI Innovation Fund, which has a growing portfolio of rural tech startups with high-growth potential. Or you can connect with our team directly to learn more!