Where are all the tech jobs in rural America, and where could we see more of them?

The first blog in a series that draws from our new report on tech training and employment in rural America, a project that was funded by Ascendium Education Philanthropy.

When thinking about the geography of tech jobs, it comes as no surprise that these types of roles are centered on major metropolitan areas — which were home to 96% of the tech jobs created between 2014 and 2019. But what may be more unexpected is that over that same time period, tech jobs were the third-fastest-growing occupation in rural counties, and in 2020 there were more tech jobs across rural areas than there were in the San Jose metro area.

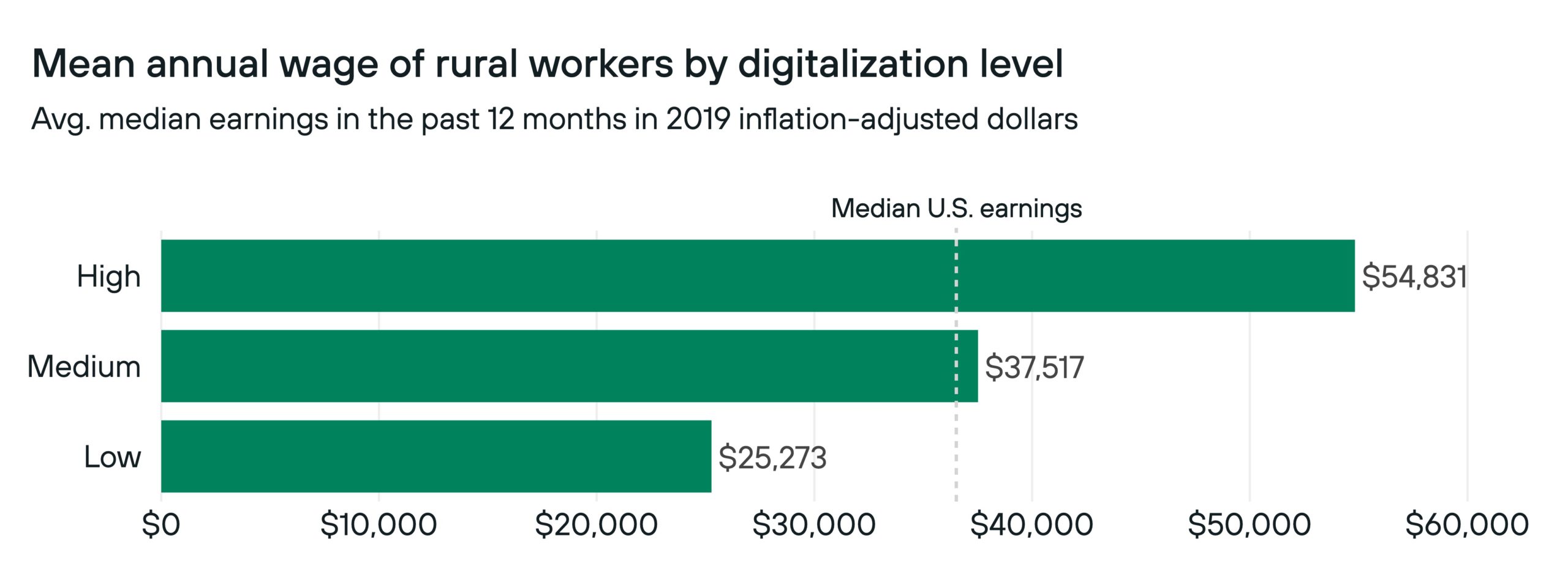

For rural workers, and especially low-income adults, this expansion of well-compensated opportunities in tech presents an opportunity: Workers in highly digital jobs earn significantly more than those in jobs that use less technology (Figure 1). When paired with access to training programs and resources to gain tech skills, tech employment has the potential to provide rural people with a path to upward economic mobility, and foster economic growth across rural communities.

Figure 1 (Source: CORI analysis using Muro et. al. (2017) classifications, American Communities Survey 2019 5-year estimates)

(Source: CORI analysis using Muro et. al. (2017) classifications, American Communities Survey 2019 5-year estimates)

Yet, on the whole, there is far less public knowledge about the tech field in rural America. This begs the question, what exactly do we know about tech employment in rural places? What do these jobs look like, and where is there room for growth?

What is a tech job?

Tech jobs refer to jobs in which people help to design, build, and maintain computer hardware and software systems, such as web developers, cybersecurity specialists, and database administrators. These jobs exist both within companies in the tech sector that sell technology products and services, and across all industries that use different sorts of technologies like health care, education, banking, and manufacturing.

Through generous funding and support from Ascendium Education Philanthropy, the Center on Rural Innovation (CORI) recently completed a study on the tech employment and training landscape in rural America. It took into account a wide swath of data, involving an analysis of labor market data, two national surveys, and over 50 interviews with tech employers, workers, learners, and training providers across rural America. With this work, we gained a deeper insight into the experiences of those working in rural tech ecosystems — knowledge that we hope will offer some new perspective to rural leaders.

This blog is the first in a series offering a peek into some of what we learned. Here, we’ll delve into what the data shows about who is actually employing tech workers in rural places.

Rural employers are understaffing people in tech roles

Digital technologies have become essential for day-to-day operations across different types of jobs and industries. Many of the industries that are using advanced tech — like manufacturing, healthcare, banking, government, and higher education — are not actually considered to be “tech industries,” given that the main focus of their work at hand isn’t necessarily to create new types of digital and technological innovations.

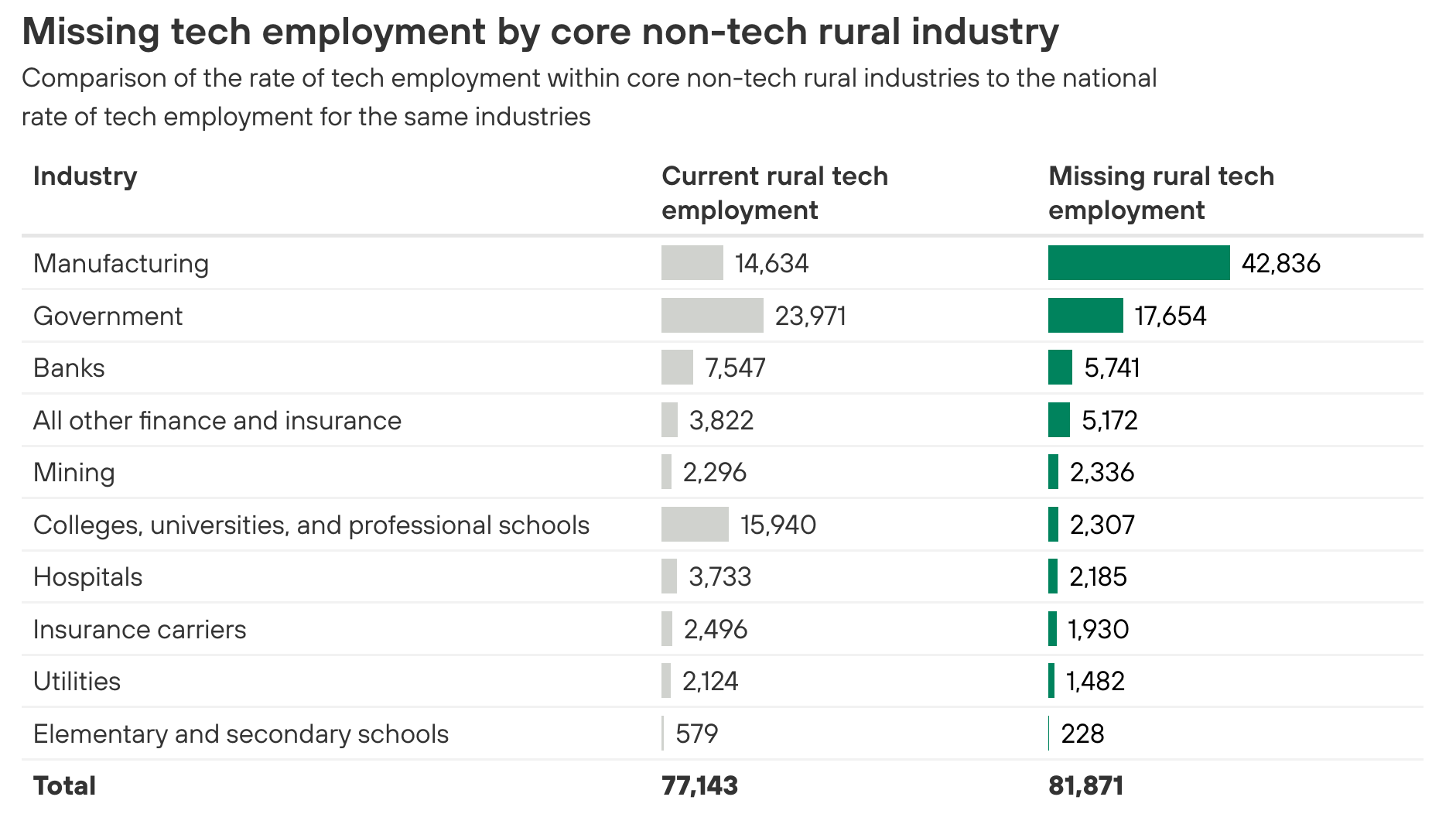

These industries play a major role in rural tech economies. In 2019, there were 244,808 rural tech workers, 30% of whom were employed in these “non-tech” industries. But based on national employment patterns, one would actually expect to see nearly twice as many rural tech jobs as we do in reality (Figure 2).

Our labor market data analysis revealed that rural employers in non-tech industries could be hiring a further 81,000 tech workers if they were hiring at the same rates as the national average for those industries — which we call “missing tech jobs” in our report. More than 40,000 of these missing jobs are in manufacturing alone, a sector in which automation has had a significant effect in reducing rural employment. Our findings suggest that these lost jobs are not being replaced by the kind of tech roles that are required to develop and maintain automation technologies.

But what is driving this understaffing of tech jobs by rural employers? There are likely several explanations.

One possibility is that rural employers are not investing enough in advanced technologies — our survey of rural employers found that fewer than half of employers have active plans in place to adapt to technological changes. Additionally, research has shown that local governments have significantly underinvested in IT infrastructure and staff to defend against cyberattacks. Another possibility, as a midwest healthcare company explained, is that employers are simply outsourcing their tech needs outside the local market. In any case, there is work to be done in encouraging and enabling rural employers to hire more tech talent, and to do so locally.

Figure 2 (Source: CORI analysis of EMSI BG data)

(Source: CORI analysis of EMSI BG data)

Rural employers aren’t employing many people in tech roles that require high levels of specialization

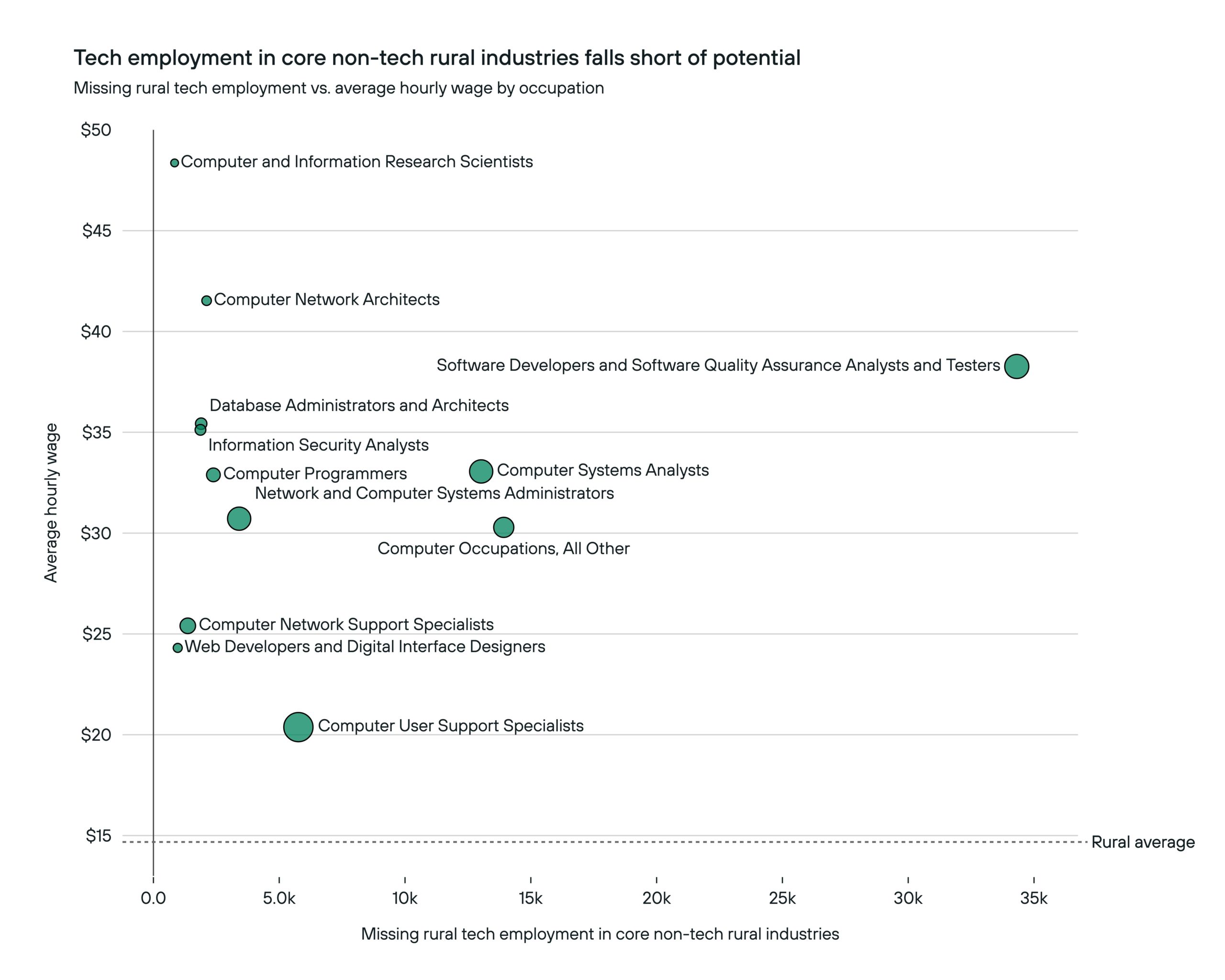

There are many different types of tech jobs across the field — the Bureau of Labor Statistics, for example, categorizes 21 different occupations in its “computer and math occupations” category. But throughout “non-tech” industries in rural places, we learned that 75% of those “missing tech jobs” include software developers, computer systems analysts, and cybersecurity and computer systems engineers.

These roles are some of the highest-paying in the field. Software developers, for example, earn an average of $38 per hour, which is more than twice the median hourly wage of $14.68 for the average rural worker.

Yet far more people are employed in more general roles that are tied to maintaining and supporting existing technologies, like network and computer systems administrators, computer user support specialists, and computer network support specialists. As a student in Bulloch County, Georgia, shared, most of the tech roles available locally were limited to “maintenance and small things” as opposed to the more “rewarding” or exciting tech work, which allows for creativity, problem-solving, collaboration, and learning on the job.

The more general roles don’t pay as much as software engineers (Figure 3), but they still earn more than the median rural worker — and often require just an associate degree or industry certification, meaning that they are more attainable by more people across income and education levels. And while these positions are essential, rural employers could also benefit from hiring more people who are trained to actually create new technologies, as these types of jobs can actually spur even greater job creation in a community.

Figure 3 (Source: CORI analysis of EMSI BG data)

(Source: CORI analysis of EMSI BG data)

What these findings mean for rural workers and local leaders

In short, rural industries are understaffing their tech operations. This all matters for rural workers because tech jobs and highly digital jobs pay high salaries, which can provide economic opportunity to rural residents and the broader community.

If rural employers are not staffing as many tech workers as they could be, then the people and places that support those employers are missing out on economic benefits that stem from tech employment. And we see that there is room for improvement, especially among the non-tech industries that are so important to rural areas, like education and manufacturing.

As local leaders and employers navigate how to increase rural tech employment across occupations and industries, they first need to learn more about their local and regional tech employment trends. There are a number of different actions they can take:

- Deepen an understanding of tech jobs and occupations. One useful resource is the data from the U.S. Census Bureau’s American Community Survey (ACS). The ACS offers insight into “Computer and Math Occupations,” which is the metric that CORI uses in its own analyses.

- Convene employers across local industries to understand their demand for tech talent. It is important to go into the conversation recognizing that some employers are likely outsourcing their tech needs to vendors outside of the region, so focus on how workforce and economic development organizations can partner with employers to shift tech employment into the local market.

- Create programs that help local employers adopt technologies. In order to stay competitive, rural businesses and industries will need to leverage technology. Programs like customized business services and local business roundtables are two ways that local leaders can work to expose employers to ways to navigate using and implementing technologies. As this planning takes place, local employers should investigate potential partnerships with local training providers to make hiring local tech workers more feasible.

Furthermore, local leaders can work to survey, interview, and convene employers in their local industries. This can help reveal a more nuanced understanding of employers’ tech talent needs, as well as barriers and opportunities to grow tech employment — knowledge that can drive priorities for training initiatives and partnerships with local schools, organizations, and higher education institutions.

We encourage you to check out our full report for more detailed case studies, recommendations, and analysis.

Interested in learning more about this topic?

The Center on Rural Innovation hosted a webinar to further discuss findings from this report. You can watch via the link below: